Welcome to the Black Hills Financial Planning blog! Today, we’re exploring ten lesser-known financial strategies that can help you leverage your assets and save money. These strategies are often overlooked, yet they hold the potential to significantly impact your financial health.

10 Little-Known Financial Strategies

1. Debt Snowball Method

The Debt Snowball Method involves paying off debts in order of smallest to largest, gaining momentum as each balance is paid off. This method can be highly motivating and helps to simplify debt repayment.

2. Utilizing Health Savings Accounts (HSAs)

HSAs are not just for current medical expenses. They can be used as a tax-advantaged way to save for healthcare costs in retirement, offering triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

3. House Hacking

House hacking involves purchasing a multi-unit property, living in one unit, and renting out the others. This strategy can significantly reduce or even eliminate your housing costs.

4. Credit Card Reward Maximization

Using credit cards strategically for everyday purchases and paying off balances each month can earn significant rewards and cash back, essentially “earning” money on what you would spend anyway.

5. Automating Finances

Setting up automatic transfers to savings accounts or investments can help you save without thinking about it, ensuring consistent growth over time.

6. Tax-Loss Harvesting

This involves selling investments at a loss to offset capital gains tax liabilities. It’s a sophisticated strategy that requires careful planning but can be beneficial for managing taxes.

7. Side Hustles

Starting a side business or freelance work can provide additional income streams, helping you to save more or pay down debt faster.

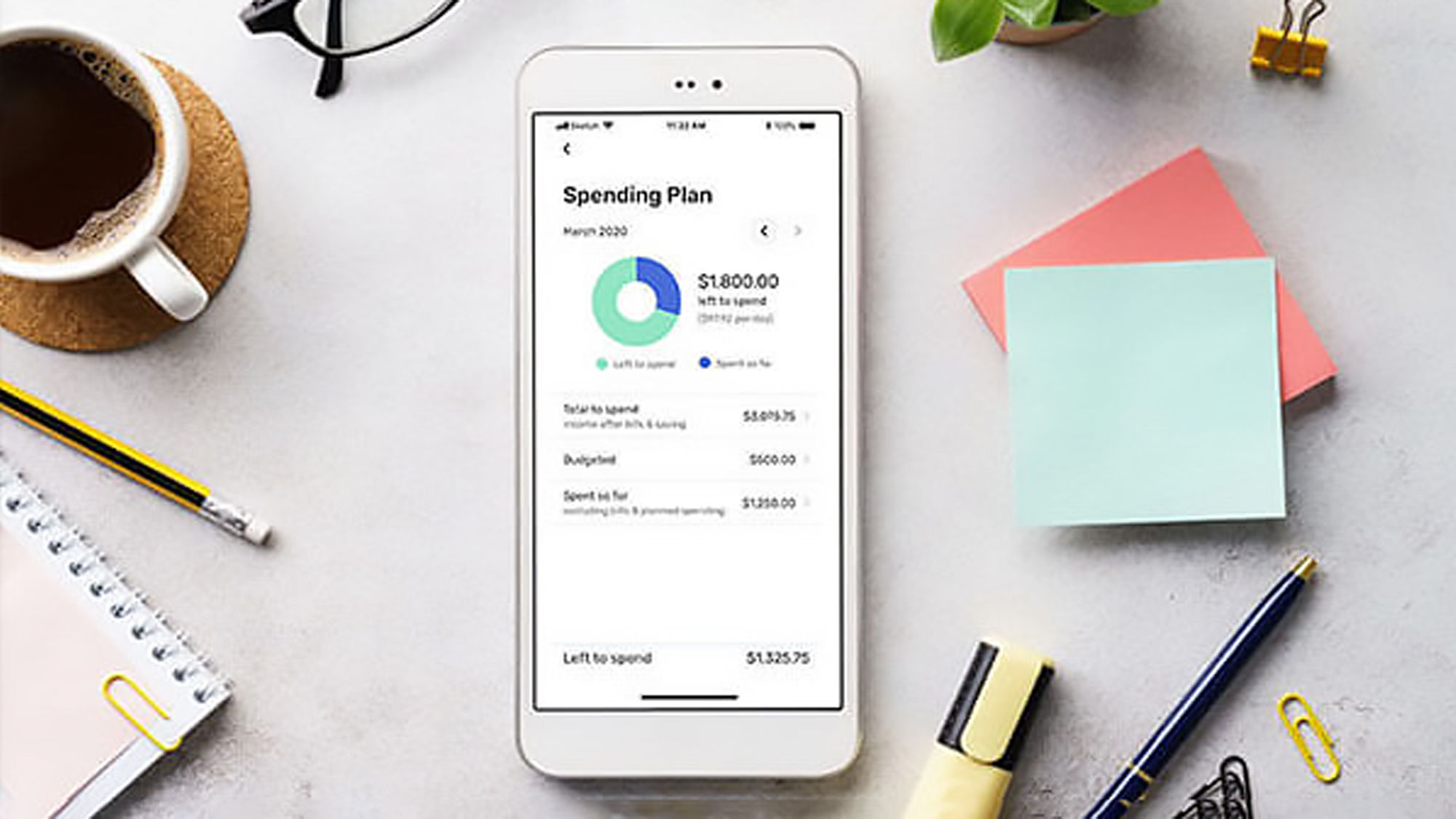

8. Utilizing Zero-Based Budgeting

Zero-based budgeting requires you to assign every dollar of income a specific purpose, whether it’s spending, saving, or investing. This method ensures efficient use of your financial resources.

9. Energy-Efficient Home Improvements

Investing in energy-efficient appliances and home improvements can lead to substantial savings on utility bills over time.

10. Renting Out Unused Space

If you have extra space in your home, renting it out on platforms like Airbnb can be a great way to generate additional income.

Conclusion

These strategies offer unique ways to leverage your financial resources and save money. Remember, financial planning is a personalized process. For more tailored advice and to understand how these strategies can fit into your financial plan, reach out to us at Black Hills Financial Planning for a consultation.

References

- “The Total Money Makeover” by Dave Ramsey – Provides an in-depth look at the Debt Snowball Method.

- IRS.gov – Information on Health Savings Accounts and their tax benefits.

- “The Book on Managing Rental Properties” by Brandon Turner – Insight into house hacking.

- NerdWallet – Provides information on credit card rewards programs.

- “The Automatic Millionaire” by David Bach – Discusses the benefits of automating finances.

- Investopedia – Offers a detailed explanation of tax-loss harvesting.

- “Side Hustle: From Idea to Income in 27 Days” by Chris Guillebeau – Covers various aspects of

- starting a side hustle.

- “Zero-Based Budgeting” by Peter Pyhrr – Introduces the concept of zero-based budgeting.

- Energy Star – Information on energy-efficient appliances and home improvements.

- Airbnb – Guide to renting out space in your home.This blog post is for informational purposes only and does not constitute financial advice. For personalized financial planning services, please contact Black Hills Financial Planning.