Living on a single income presents unique financial challenges, but building a robust emergency fund is not only possible—it’s essential. Whether you’re a one-income household by choice or circumstance, having a financial safety net can mean the difference between weathering a crisis and falling into debt.

Why Emergency Savings Matter Even More for Single-Income Families

When your household relies on one paycheck, you’re facing a concentrated risk. If that income source is disrupted due to job loss, illness, or injury, your family has no backup. Unlike dual-income households, where one partner’s income can sustain the family temporarily, single-income families need a more substantial cushion.

The reality: According to recent surveys, nearly 60% of Americans couldn’t cover a $1,000 emergency expense from savings. For single-income families, this vulnerability is magnified.

How Much Should You Save?

The traditional advice is to save three to six months of expenses, but single-income households should aim higher.

Recommended targets:

- Minimum goal: Three months of essential expenses (mortgage/rent, utilities, food, insurance, minimum debt payments)

- Stronger position: Six months of total household expenses

- Ideal target: Nine to twelve months for single-income families, given the concentrated income risk

Start with whatever goal feels achievable. Even $1,000 can prevent a minor crisis from becoming a major financial setback.

Smart Strategies to Build Your Emergency Fund

Start Small and Be Consistent

You don’t need to save thousands immediately. Begin with what you can manage, even if it’s just $25 or $50 per paycheck. The key is consistency and automation.

Action step: Set up an automatic transfer from your checking account to a dedicated savings account on payday. Treat this transfer like any other non-negotiable bill.

Find Money in Your Current Budget

Review your spending over the past three months and identify areas where you can trim temporarily:

- Reduce dining out by cooking one additional meal at home each week

- Cancel subscriptions you’re not actively using

- Lower your grocery bill with meal planning and generic brands

- Negotiate better rates on insurance, internet, or phone service

- Reduce energy costs with simple efficiency improvements

Even finding an extra $100-200 per month adds up to $1,200-2,400 annually.

Use Windfalls Wisely

Tax refunds, work bonuses, gift money, or unexpected cash should go directly into your emergency fund until you reach your goal. It’s tempting to splurge, but these windfalls can accelerate your progress significantly.

Generate Additional Income (Strategically)

If the stay-at-home parent has capacity, consider income sources that don’t compromise the primary reason for staying home:

- Freelance work during nap times or evenings

- Selling items you no longer need

- Part-time remote work with flexible hours

- Seasonal work during times when childcare is less demanding

The working partner might explore overtime opportunities, one-time projects, or asking for a raise if they’re due for one.

Where to Keep Your Emergency Fund

Your emergency savings need to be accessible but not too accessible. Consider these options:

High-yield savings accounts: These offer better interest rates than traditional savings accounts (currently 4-5% APY) while keeping your money liquid and FDIC-insured.

Money market accounts: Similar to high-yield savings with competitive rates and easy access to funds.

Avoid: Don’t keep emergency funds in checking accounts where they’ll blend with daily spending, or in investments where you could lose principal or face penalties for early withdrawal.

Overcoming Common Obstacles

“There’s Nothing Left to Save”

If your budget is truly maxed out, focus on increasing income rather than cutting expenses. Even an extra $50-100 per month from a side project can launch your emergency fund.

“We Keep Dipping Into Savings”

This suggests either your budget isn’t realistic or you’re conflating wants with emergencies. Define what constitutes a true emergency beforehand, and keep these funds in a separate account that’s not linked to your debit card.

“It Feels Impossible on One Income”

Progress, not perfection, is the goal. Saving $50 monthly for a year gives you $600—enough to handle many common emergencies. In two years, you’ll have $1,200. Keep going.

Building While Paying Down Debt

If you’re carrying high-interest debt, you face a dilemma: save or pay off debt? The answer is both, but strategically.

Recommended approach:

- Build a starter emergency fund of $1,000-1,500 first

- Aggressively pay down high-interest debt (credit cards, payday loans)

- Once high-interest debt is cleared, redirect those payments to building a full emergency fund

- Then tackle remaining debts while maintaining your emergency savings

This balanced approach prevents new debt when emergencies arise while you’re paying off existing obligations.

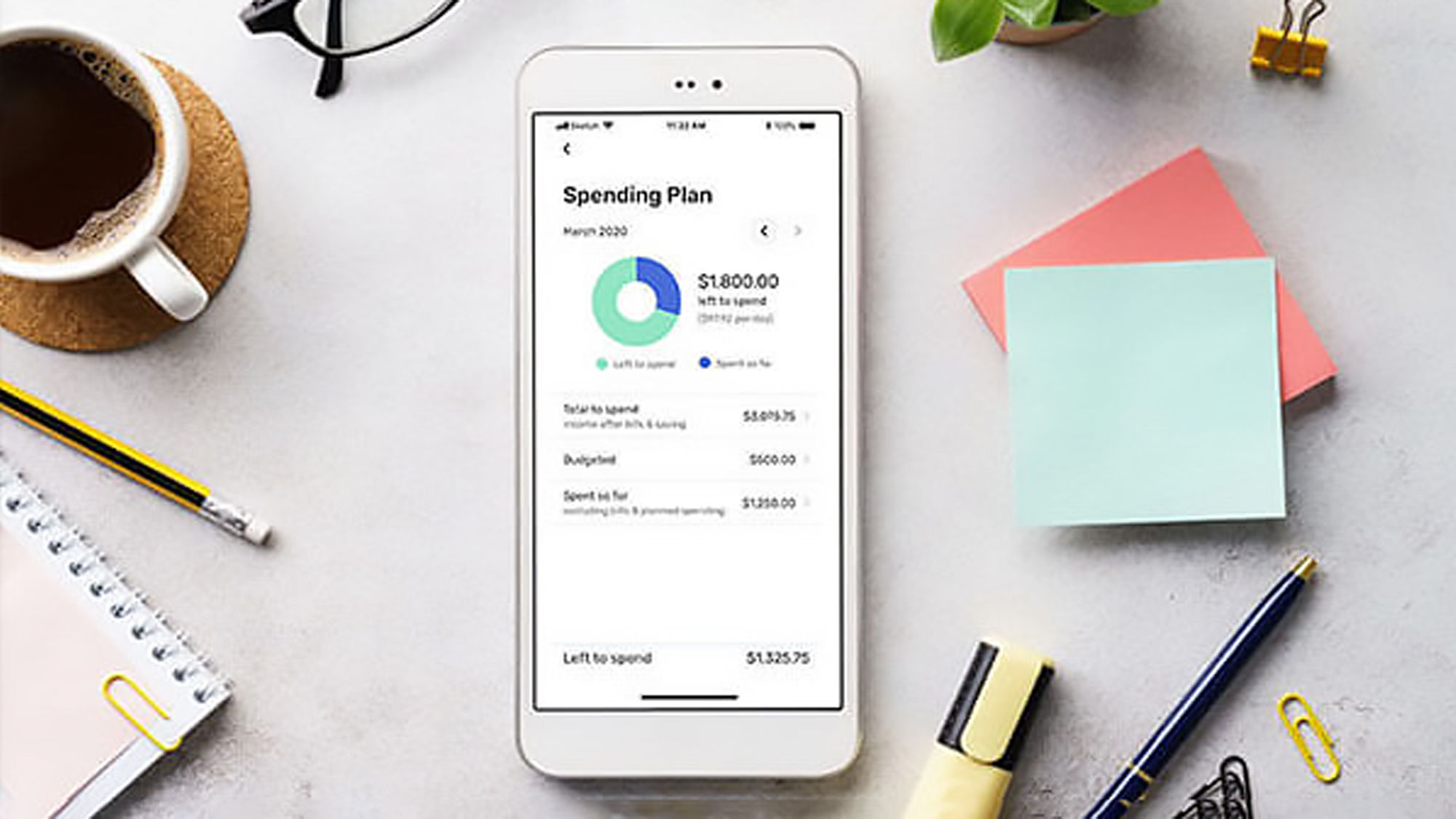

Tracking Your Progress

Visualizing your progress helps maintain motivation. Create a simple chart, use a savings app, or mark milestones on a calendar. Celebrate reaching each thousand-dollar increment or each month of expenses saved.

Milestones to celebrate:

- First $500 saved

- One month of expenses covered

- Three months of expenses covered

- Six months of expenses covered

When to Use Your Emergency Fund (and When Not To)

Legitimate emergencies include:

- Unexpected medical expenses not covered by insurance

- Major home or car repairs essential for daily living

- Job loss or significant income reduction

- Emergency travel for family crisis

Not emergencies:

- Holidays and gifts

- Annual expenses you could have planned for

- Wants disguised as needs

- Regular bills that come due

If you use your emergency fund, make replenishing it your top financial priority.

The Peace of Mind Factor

Beyond the practical benefits, emergency savings provide something invaluable: peace of mind. Knowing you can handle unexpected expenses reduces stress, improves sleep, and allows you to focus on what matters most—your family.

For single-income families, this security is transformative. You’re no longer one car repair or medical bill away from financial crisis. You’ve created breathing room and options.

Taking the First Step Today

Building emergency savings on a single income isn’t easy, but it’s achievable with commitment and consistency. The families who succeed aren’t necessarily those earning the most—they’re the ones who make saving a priority and stick with it through the inevitable challenges.

Start today, not tomorrow. Even if you can only save $20 this week, that’s $20 more than you had. In six months, you’ll be grateful you began when you did.

Ready to create a comprehensive financial plan for your single-income family? Black Hills Financial Planning specializes in helping families navigate unique financial situations. Contact us today to discuss strategies tailored to your specific goals and circumstances.

Discover more from Black Hills Financial Planning

Subscribe to get the latest posts sent to your email.