Money plays a significant role in any relationship, and how a couple manages their finances can either strengthen or strain their partnership. The key to financial harmony lies in open communication, shared goals, and a solid budgeting strategy. In this article, we will explore 15 recommendations on how couples can work together to budget and spend more wisely, fostering not only financial stability but also a deeper connection with each other.

1. Open and Honest Communication

The foundation of successful financial management in a relationship is open and honest communication. Both partners should be comfortable discussing their financial goals, concerns, and expectations without judgment.

2. Set Shared Financial Goals

Sit down together and establish clear, shared financial goals. Whether it’s saving for a vacation, buying a home, or planning for retirement, having common objectives can provide motivation and direction for your financial journey.

3. Create a Budget Together

Work together to create a comprehensive budget that outlines your income, expenses, and savings goals. Allocate specific amounts to different categories, and make sure to revisit and adjust the budget as necessary.

4. Financial Date Nights

Schedule regular “financial date nights” where you can discuss your budget, review your progress, and make necessary adjustments. This dedicated time can strengthen your financial partnership.

5. Emergency Fund

Set up an emergency fund together. Having a financial safety net can provide peace of mind and prevent unexpected expenses from derailing your budget.

6. Joint and Separate Accounts

Consider both joint and separate bank accounts. Joint accounts can be used for shared expenses, while separate accounts allow for personal spending and financial independence.

7. Transparency

Maintain transparency by sharing account statements, passwords, and financial information. Trust is essential in financial matters, and this transparency fosters it.

8. Automate Savings

Automate your savings by setting up regular transfers to your savings accounts. This ensures that you consistently contribute towards your financial goals.

9. Prioritize Debt Reduction

If you have debts, create a plan to tackle them together. Prioritize high-interest debts and work as a team to pay them off as soon as possible.

10. Track Spending

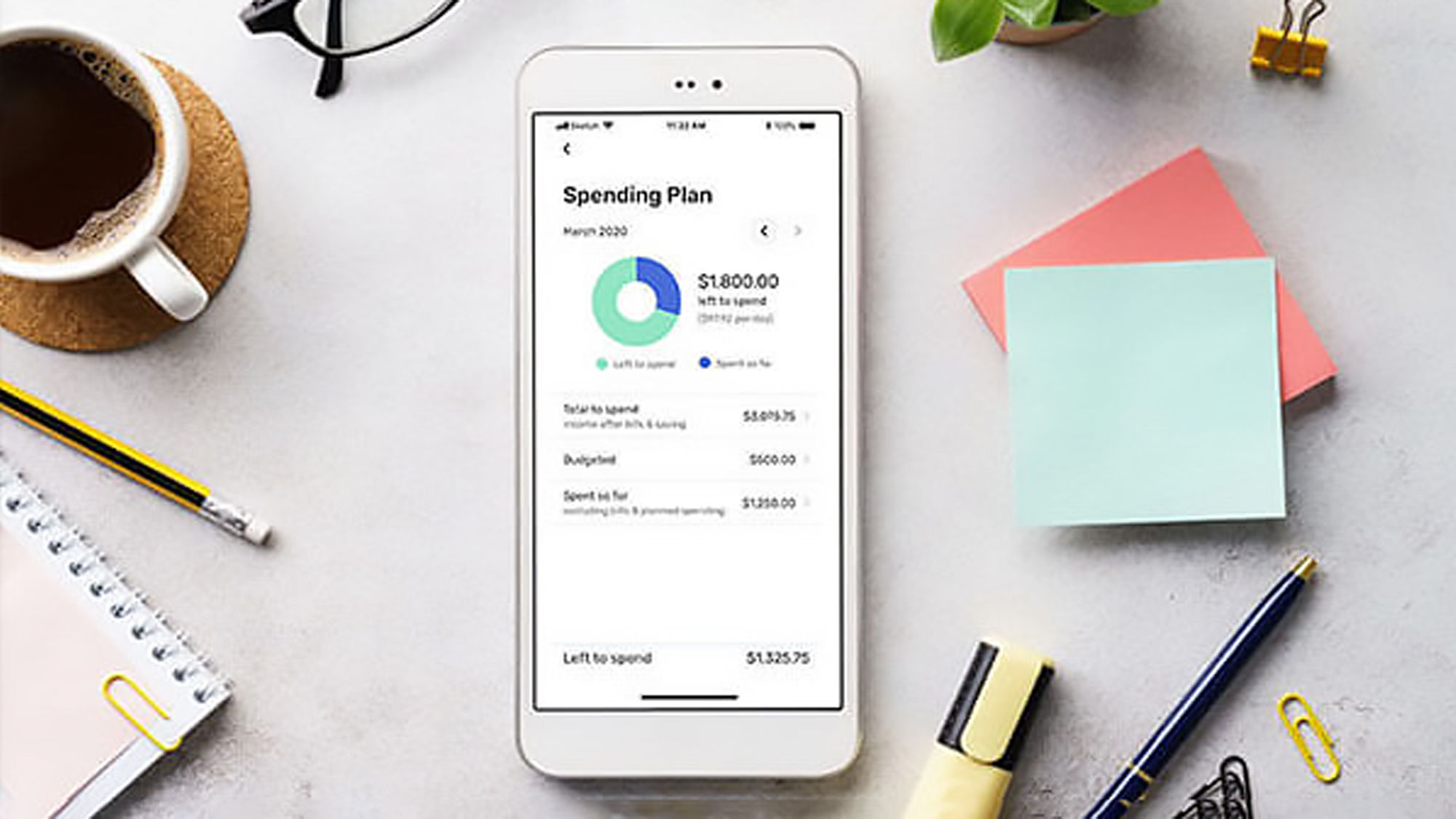

Use budgeting apps or spreadsheets to track your spending. Regularly reviewing your expenditures can help identify areas where you can cut back.

Credit: Library.EveryIncome.com

11. Define Financial Roles

Clearly define each partner’s financial responsibilities. Whether it’s bill payments, investments, or managing the budget, understanding your roles can prevent misunderstandings.

12. Celebrate Milestones

Celebrate financial milestones together. Whether it’s reaching a savings goal or paying off a significant debt, acknowledge your achievements as a team.

13. Seek Professional Advice

Consider consulting a financial advisor or counselor if you encounter persistent financial challenges or disagreements. A professional can offer guidance and mediate discussions.

14. Set a Spending Limit

Agree on a spending limit for discretionary expenses, such as dining out or shopping. This ensures that both partners have some financial freedom while staying within the budget.

15. Practice Patience and Compromise

Financial disagreements are common in relationships, but it’s crucial to practice patience and compromise. Approach conflicts with empathy and a willingness to find common ground.

In conclusion, budgeting and spending wisely as a couple is not just about managing money but also about building a strong foundation for your relationship. Open communication, shared goals, and a commitment to financial harmony can lead to a deeper connection and a more stable future. By following these 15 strategies, couples can work together to create a healthier financial partnership and a brighter financial future.