When it comes to finding the perfect place to call home, Midwest homebuyers have a unique set of opportunities and considerations. From charming suburban neighborhoods to idyllic rural settings, the Midwest offers a diverse range of real estate options. However, navigating the homebuying process requires careful financial planning. In this article, we’ll delve into essential steps that Midwest homebuyers should take to ensure a successful and financially sound home purchase. Whether you’re a first-time buyer or looking to relocate, these tips will help you secure your dream home without compromising your financial stability.

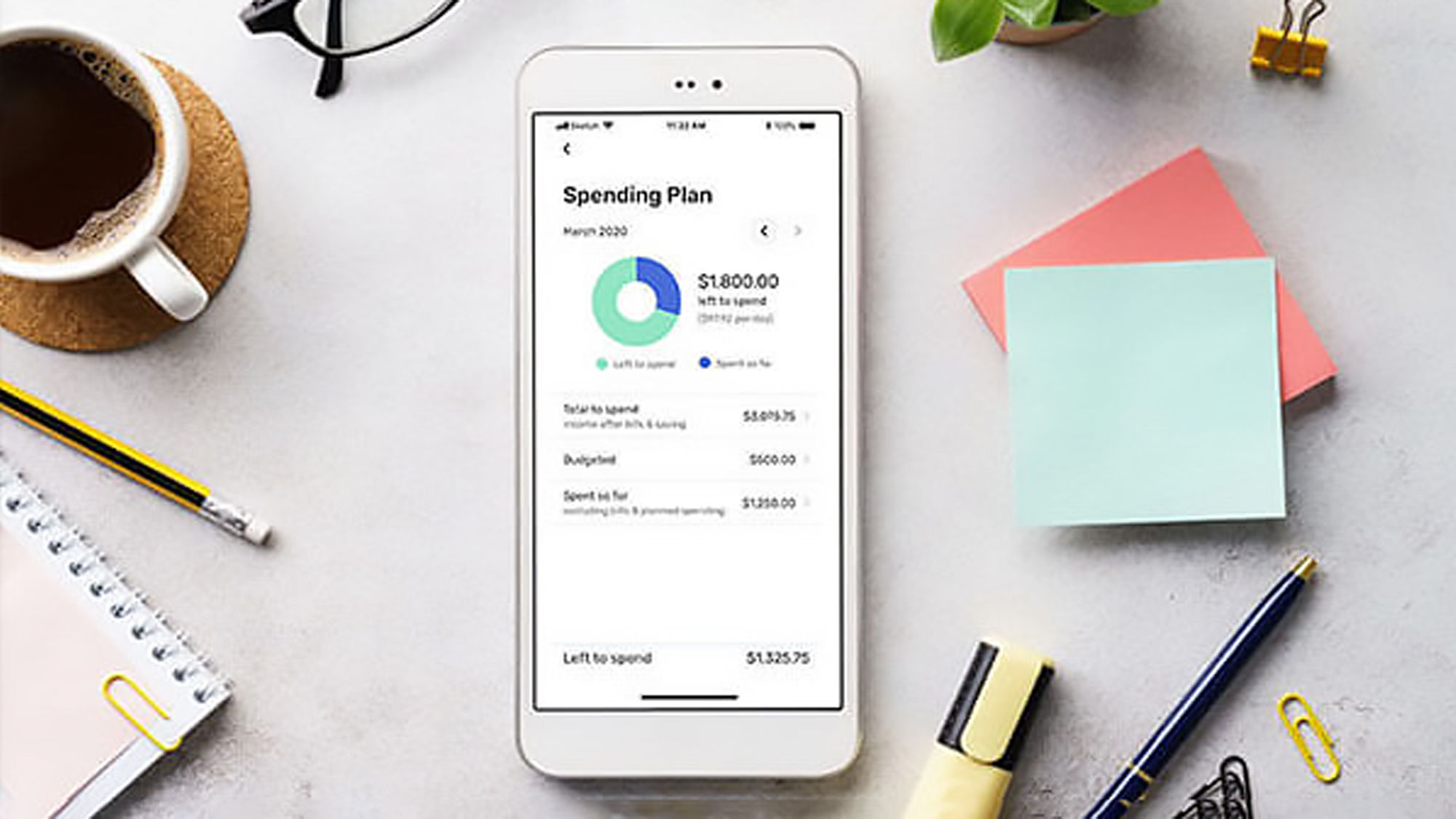

1. Establish a Realistic Budget

Before embarking on your homebuying journey, it’s crucial to establish a realistic budget that takes into account your current financial situation, income, expenses, and any existing debts. This budget will serve as a guideline to help you determine how much you can comfortably afford to spend on your new home.

2. Research the Local Real Estate Market

Different regions within the Midwest have varying real estate trends and property values. Research the local housing market to understand the average home prices, property taxes, and potential appreciation rates in your desired area. This knowledge will help you make informed decisions when it comes to making an offer on a property.

3. Get Pre-Approved for a Mortgage

Securing a pre-approval from a reputable lender gives you a clear picture of how much you can borrow and demonstrates your seriousness as a buyer to sellers. This step is essential in a competitive market and allows you to focus on homes within your price range.

4. Factor in Closing Costs

Credit: Pexels

Aside from the down payment, it’s important to consider closing costs, which typically range from 2% to 5% of the home’s purchase price. These costs cover expenses such as appraisal fees, title insurance, and attorney fees. Budgeting for closing costs ensures that you’re financially prepared for the final stages of the homebuying process.

5. Evaluate Homeownership Expenses

Owning a home involves more than just the mortgage payment. Consider additional expenses such as property taxes, homeowners’ insurance, utilities, maintenance, and potential homeowners association (HOA) fees. These ongoing costs should be factored into your budget to avoid any financial surprises down the line.

6. Assess Down Payment Options

While a 20% down payment is often recommended to avoid private mortgage insurance (PMI), there are various down payment assistance programs available for Midwest homebuyers. Research state and local programs that can help you achieve homeownership with a smaller down payment.

7. Plan for Potential Renovations

If you’re considering a fixer-upper, factor in the costs of renovations and repairs. Getting quotes from contractors and estimating the expenses associated with updating the property can help you determine whether the investment is financially feasible.

8. Consider Long-Term Financial Goals

Before finalizing your home purchase, consider how it aligns with your long-term financial goals. Will the property serve as a long-term investment? Does it accommodate potential lifestyle changes? Thinking ahead can help you avoid outgrowing your home too quickly.

For Midwest homebuyers, achieving the dream of homeownership requires thoughtful financial planning. By establishing a realistic budget, researching the local market, and factoring in all associated costs, you can make informed decisions that lead to a successful and financially sound home purchase. Remember that a well-planned homebuying journey sets the foundation for a comfortable and enjoyable life in your new Midwest home.

References:

- Dave Ramsey. “How Much House Can I Afford?” DaveRamsey.com. https://www.daveramsey.com/blog/how-much-house-can-i-afford

- Investopedia. “What Are Closing Costs?” Investopedia.com. https://www.investopedia.com/mortgage/closing-costs/

- U.S. Department of Housing and Urban Development. “Buying a Home.” Hud.gov. https://www.hud.gov/topics/buying_a_home