A budget is a plan for spending and saving money. It can help you track your income and expenses, and make informed financial decisions. There are many different ways to create a budget, but the following steps can help you get started.

1. Calculate your income and expenses.

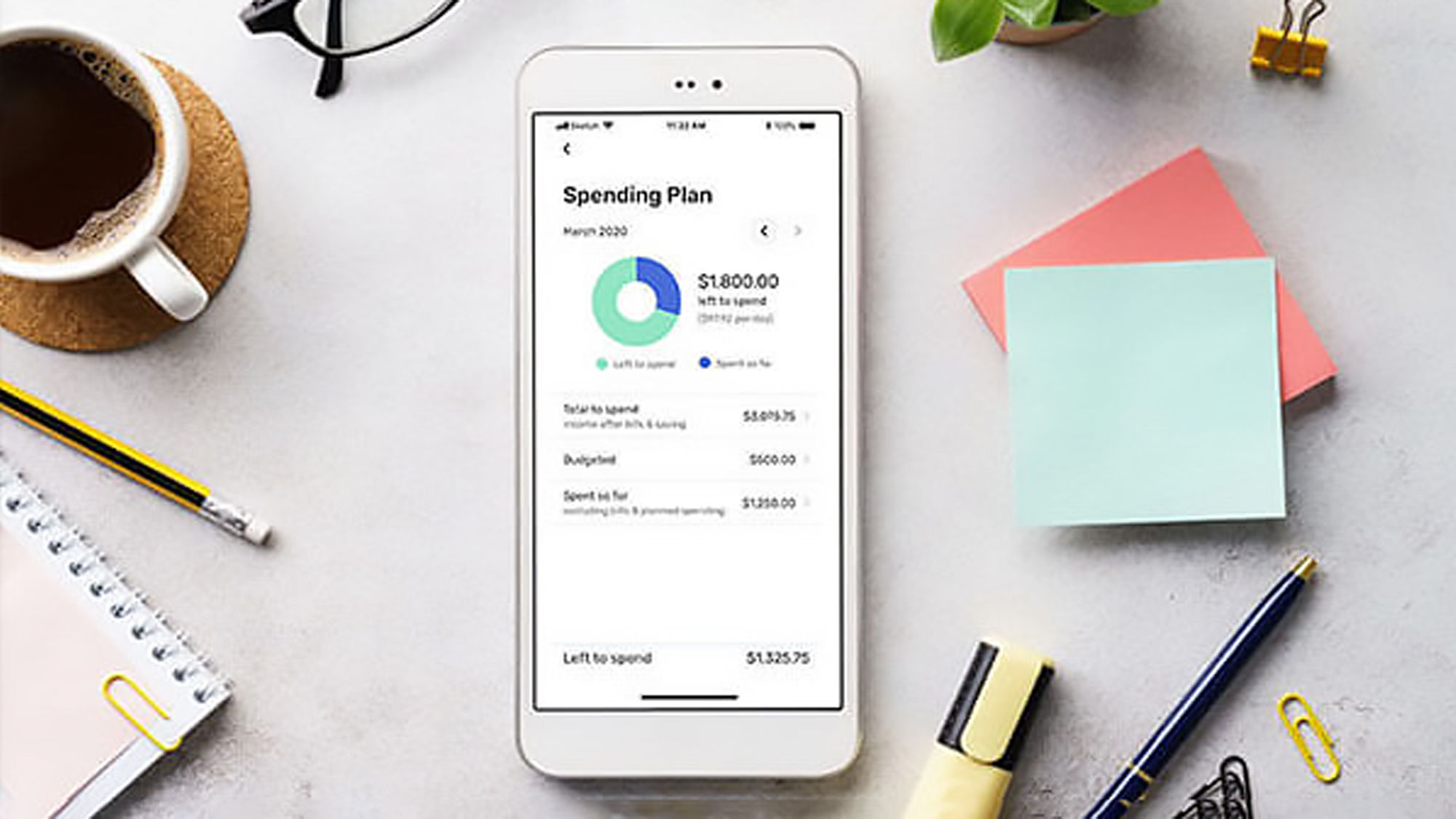

Start by logging into your banking application to review your spending trends. Most financial institutions offer this service as a courtesy. For instance, Black Hills Federal Credit Union has a “money management” app that allows you to view trends and set limits for spending in various categories. Once you know how much you are spending, then you can determine where and by how much you need to be more aware of your spending.

2. Determine what you need versus what you want

This can be a difficult step, but it is important to differentiate between what is a necessity and what is a luxury. For example, you may need a car to get to work, but you don’t need a luxury car. You may need a place to live, but you don’t need a mansion. Having a realistic perspective on how much you actually need to enjoy life (instead of allowing the mainstream media and popular culture to inform you) will help you save money and meet your budgeting goals.

An important lesson to learn is that most rich people live as if they are poor to conserve their wealth and most poor people live as if they are wealthy due to wanting it now. The key is long-term gratification and accepting that you don’t need everything you want now. Most of those desires are temporary anyway, which means they don’t hold much – if any – real value and will no longer provide you joy within a short period of time.

3. Review your fixed expenses

Fixed expenses are those that do not change from month to month, such as rent, car payments, and student loan payments. If you are having trouble meeting your budget, it may be necessary to review your fixed expenses and see if there are any ways to reduce them.

4. Review your variable expenses

Variable expenses are those that change from month to month, such as groceries, utilities, and gasoline. One way to reduce your spending in this category is to create a budget for each month and then stick to it. This may require some self-discipline, but it is important to be mindful of how much you have to spend so you don’t go over budget.

Ways to reduce variable expenses include: making lunches at home (instead of buying food on-to-go between meetings) and carpooling to reduce your gas bill each month.

5. Create a savings goal

One of the best ways to meet your budgeting goals is to create a savings goal. This could be for something as specific as a new car or as general as a rainy day fund. The key is to make sure that your savings goal is realistic and achievable.

Example: If you want to save $10,000 within one year to buy a new car, understand how much money is earned each month and what your average expenses are. Put away 10% of every paycheck for a rainy day fund (it is advised to save 6 months’ income in the event a calamity happens) and then calculate the difference that is left over. That will help you determine if you’re on track to meet this goal, as well as if it is reasonable.

Creating a budget is not an easy task, but it is a necessary one if you want to be successful with your finances. By following the steps above, you can develop a budget that works for you and helps you achieve your financial goals.

Discover more from Black Hills Financial Planning

Subscribe to get the latest posts sent to your email.