Maybe it was the pandemic, maybe your kids are finally in school, or perhaps your family situation has changed. Whatever the reason, you’re looking at changing jobs. It is an exciting time, but one that also has a few hidden challenges that you might not be quite prepared for. One of these is the added expenses of seeking a more rewarding or higher-paying career.

This article offers some insight as well as budget-friendly tips to help women navigate their finances during the transition.

Why Change Jobs

Women are more likely to change jobs than men, and there are many reasons for this. For women, better pay and more inclusive culture is likely to top the list. Changing jobs is also an opportunity to pursue something you love and to step outside of your comfort zone. This is especially true when you opt to sidestep the mainstream time clock to work for yourself. Many of us today are ditching the 9-to-5 to work as a freelancer so that we can have balance and make the money we need to keep our bills paid and our lifestyle comfortable.

When you choose to walk the self-employment path, you run into the possibility of not having an income for a while. Even when you’re just changing jobs, there is still the chance that your income might get off track, at least for a little bit.

Obvious Costs

When changing jobs, there are costs that we expect. Clothing, extra fuel and vehicle maintenance, resume services, and, if choosing self-employment, start-up costs and marketing expenses. While these are not the only things you might expect to pay for, they are the most obvious.

Unexpected Expenses

There are also costs that you might not anticipate. These are a little harder to pinpoint, and you can get lost in the excitement of change that you may initially overlook things like:

- Relocation fees. While many companies offer a fair relocation package, you will still have to pay for things like your own gas, new furniture, and turning on utilities and cable services.

- A different pay structure. Before you change jobs, look ahead at the pay and bonus compensation structure offered by your new employer. While you might be used to a recurrent profit-sharing bonus, your new company may only dole out extra cash at sign on or once each year.

- Taxes. While likely not a huge problem, changing jobs means your new employer has to withhold money from your paycheck, even if your former employer has already met the approximately $8,000 threshold. You’ll get the money back, but it is a short-term consideration.

- Healthcare costs. If you’ve already met your healthcare deductible at your current employer, you may not be prepared to shell out an extra $1,655 (on average) for your deductible on a new employer-sponsored plan.

- Lifestyle changes. Changing jobs is often accompanied by lifestyle changes. This might mean buying a new car or going out to lunch with your coworkers more often. Budget accordingly.

Offsetting The Additional Debits

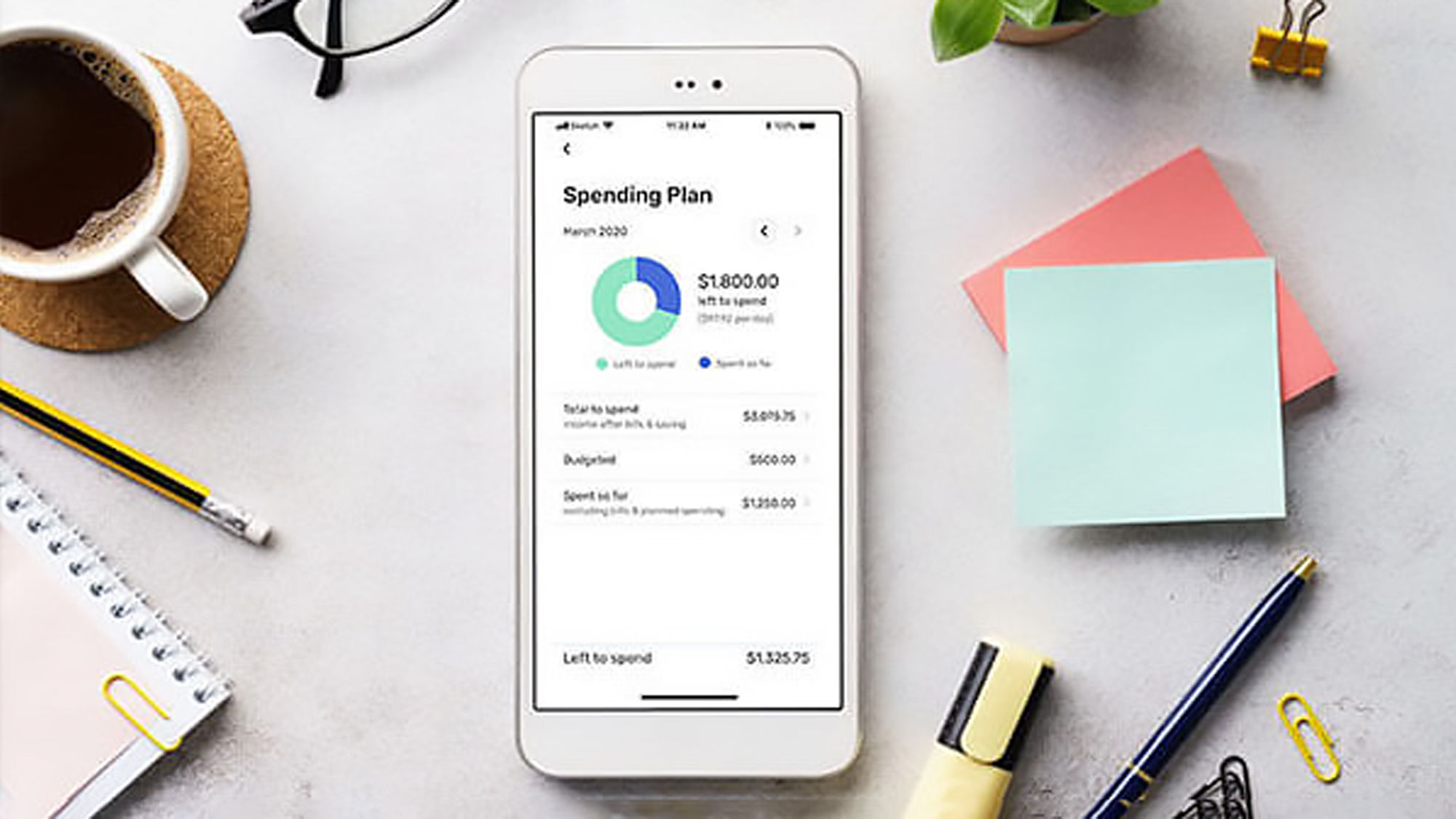

If you haven’t gotten your calculator out yet, now might be a good time to figure out how much more, exactly, you’ll be out each month. Even if your income deficit will only last temporarily, you don’t want to live uncomfortably until things stabilize once again. Chances are, there are plenty of ways that you can save so that the financial impact is minimal to nonexistent.

A great place to start is by shaping business expenses if you’re now a freelancer, contractor, or entrepreneur. You might, for example, forgo paper invoices or hire other freelancers to handle routine tasks instead of taking someone on the payroll full-time. You can also switch your business and personal phones to a less expensive carrier; some may even pay an early termination fee on your behalf to a different company. And when it comes to establishing your business as an LLC for tax benefits and personal asset protection, using a formation service can be a cheaper alternative to a pricey attorney.

You can also talk to your new employer about telecommuting/remote working periodically as you get settled in. This will save you on fuel and will give you the time to get your new home in order if you’ve moved as part of your job change.

Other general budgeting tips include not eating out as often, buying used clothes, and paying off your credit cards each month to avoid interest. If you’re a homeowner, you can also consider refinancing to reduce your monthly mortgage payments.

There are lots of expenses that go along with changing jobs. Some of these you anticipate, others may be a complete surprise. But, if you know what you’re looking at, you’ll be in a better position to negotiate things like relocation expenses, bonuses, and even your base salary. Good luck in your new endeavor, and congratulations on taking the next step toward personal and financial freedom.

Work with the trusted advisors at Black Hills Financial Planning to create a plan for your financial future. Complete this form to schedule a free consultation today!

Image via Pexels